Stock Watchlist 11.22.10

EROC LNG SCOK HLYS HAUP THQI TQNT

More and more trades working out. My strategy has been on fire lately so really no need to change. R. As time goes on you remember the stocks you trade and their history. That’s how big money is made. Learn to recognize what you see and NOT what you think you should see. The best dividend is common sense.

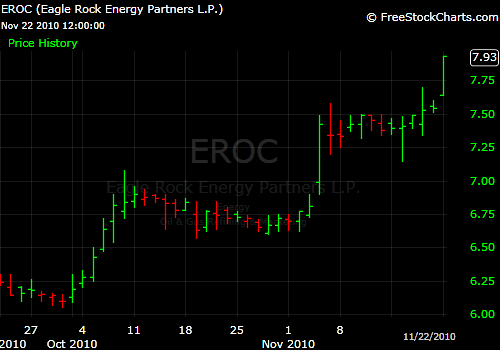

EROC

Had this on short watch early Monday. When I shorted APRI I lost track of this one. I didn’t realize it popped so much at the end of the day. Therefore I would like to see a repeat of Monday. A 3 to 4 green bar open ( 5 minute chart ) and then catch the exhaustion. Very similar to APRI.

LNG

This was also on short watch and was a great short for those who took it ( I didn’t). The stock pulled off a ton from it’s highs to close red. That was a significant turn around and it’s only the first red day. As much as this stock is up there is plenty of room below.

SCOK

Bounces off a very well tested base of 8.25ish, i wonder if it has the legs to challenge 10.50 and then maybe breakout from there. If it gets away from me Tuesday I may short it because SCOK is notorious for fading.

HLYS

Noticed that it’s been inching up the last few days and close to that pivotal 3.20. This stock will certainly come back some because they are a joke. HLYS is damn near broke and I don’t consider a wheeled footwear company “retail”

HAUP

Thanks to sparky in chat for bringing this up as I completely missed this. I ‘ve traded HAUP a few times in the past . What I didn’t like about it is that it gives you the impression it’s going to tank but then it bounces. Shorts usually work out but you have to be patient. Pretty safe bet it will be lower on Friday than it is today.

THQI

Nice chart that I pulled up from a scan. It’s an earnings runner and on it’s 4th day of gains. Not sure there will be a fifth. I’m neutral on the stock now but leaning a little short because of the excessive run.

TQNT

In the midst of a breakout pattern perched at the highs. There has been a lot of insider selling this month and the stock is still moving up. Maybe they need the money for Christmas or maybe they are grabbing their cash while the stock is up. No play for now we’ll see Tuesday