Penny Stock Hit List for 10.11.10 DCTH HDY FUQI GROW BORN REDF ABIO ABK HSWI SEED

We are treading on unique territory with the bullish sentiment lately. The market just shrugged of the bad jobs report and kept buying up stocks. We will see how the remaining week plays out. I hope not to get distracted by micro cap bashers week.

Last week there was some call outs and some big stick swinging contests flying all over the boards between sub services. Each looking to gain notoriety in hubrisville. Most of it in my opinion is a ploy for attention but maybe it works. I might have to try it. This is what happens when there is a lack good pump and dumps available.

It got so bad at one point, as I was watching Tim Sykes livestock, two Spanish ladies started duking it out in the background of the Internet cafe he was in. Tension is tight around the world! I’m focusing on body slamming some stocks this week. For reals!

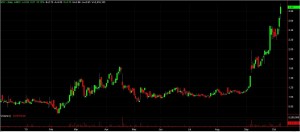

DCTH

We discussed the buyout rumors in chat on Friday. At the moment nothing has been confirmed. If this doesn’t service this week. DCTH will get a haircut. There was also positive news published. I am currently bullish on this for Monday but I will change my stance in a minute if the tape gets weak. Story here

Delcath Systems, Inc. (Nasdaq: DCTH), a medical technology company testing its proprietary treatment method for primary and metastatic cancers to the liver, announced that the Data and Safety Monitoring Board (”DSMB”) reviewed clinical data on 77 patients enrolled in its pivotal Phase III clinical trial and unanimously recommended that the trial continue to enroll patients with the goal of reaching the 92 patients required to complete the study. In addition, the Company announced it now expects enrollment to be completed by mid-October.

Eamonn Hobbs, President and CEO of Delcath Systems stated, “We are pleased by the successful review of our safety data and the recent, accelerated pace of enrollment, which has put us in the trial’s home stretch. This is an exciting time for the Company. With current enrollment trends, we now expect to complete enrollment by the middle of October and are still on track for an FDA submission by mid-2010.”

The DSMB is an independent group of experts with the responsibility for reviewing and evaluating the safety and response data generated from the Company’s Phase III trial. The primary responsibilities of the DSMB are to ensure the safety of all patients enrolled in the trial, the quality of the data collected and the continued scientific validity of the trial design. The DSMB reviews data periodically in order to make an informed risk versus benefit recommendation concerning the continuation, modification, or termination of the trial due to safety concerns. This DSMB review was triggered upon randomization of the 77th patient which marks the 75% enrollment point for the trial.

About the Phase III Study

This clinical study is testing the Delcath PHP System(TM) for the regional delivery of melphalan to the liver to treat patients with metastatic cutaneous and ocular melanomawho have unresectable tumors in the liver. The Delcath PHP System(TM) is designed to deliver significantly higher doses of anti-cancer drugs to a patient’s liver while minimizing entry of the drugs into the rest of the patient’s circulation. This isolation limits toxicities which result from systemic chemotherapy treatments.

Patients in the Phase III trial are randomized into one of two treatment arms, including immediate treatment with melphalan via the Delcath PHP System(TM) or treatment with best alternative care. The study is designed to evaluate the duration of tumor response in each of the two study arms. Following guidelines established by U.S. Food and Drug Administration under a Special Protocol Assessment (SPA), patients are permitted to “cross-over” from the best alternative care arm to receive treatment with the Delcath System at the time of disease progression.

FUQI

Chinese jewelry comes at a premium. I have taken a few shots a FUQI in the past. They are semi legit but I think this pop is stupid. I would have liked to put in a buy Friday morning but I totally missed it. Now I do not want to buy it.In the past it never turned out to be a dynamite short so if I do try to short it off of a spike it will most likely be a scalp as I don’t see a death drop. We will see what the tape says Monday.

HDY

Another stock we covered in chat. No additional data showed up this weekend so my stance is bullish. I was discussing this stock with a member in chat on Friday and I said the stock would go to $3 at least because of the CFO holding payable options at $3. When the stock hit 2.90 I wanted to smack myself for not buying some at that price. I don’t want to chase it so if there is a pullback and consolidation I will pull the trigger Monday.

GROW

Losing a little luster on this one. There is a nice doji star on the daily chart so despite the good news GROW may pull down from here. I will not chase this stock either because every small sell of has been met with a ton of buyers so I will play it from the cautious side.

BORN

I though Friday might be a sell of day but I was wrong this stock is off the charts, literally. Neutral now but definitely a watcher.

Others to watch REDF ABIO ABK HSWI SEED ( all shorts)