Lincoln Alerts Stocks for 7.8.14

Only 2 Losing Days All Of June! What A Month

Free trial available. Click here to Trade With Us Free

I was nice to get back in the swing of things after missing most of last week . I was only out for 2 days but it felt like I was gone a century. It seems that with each day you take off you need 1 hour the following day to recover from the “take off hangover”. Still we had some great trades and some nice profits on Monday. Join us Tuesday for free.

Watchlist $CAMT $BBRY $EVRY $GTAT

CAMT

This is probably on the top of everyone else’s watchlist as well. This is another former runner which is very similar to what we saw last week with USU and LITB. Of course the top play will be a parabolic move very early up to about the $5.80 resistance area from January 29. If that happens I would be heavy short provided shares were available. If there’s a slight pullback in the morning or a basing pattern I wouldn’t rule out a buy as a second day run could be possible just like what we saw with USU

BBRY

We were talking last week about BBRY having another move up towards the $12 area. I now think if that happens that’s taking us into the resistance of last August before that we have resistance in mid-September around $11.58. Since I missed out on the break I will focus on those two numbers for potential short entries. Preferably $12

EVRY

This is a nice intraday chart over the last three days of trading. Although this thing seems to fade towards the end of the day it still hasn’t been flushed out so I wouldn’t rule out the possibility of this thing going higher. There could still be another test of that $4 dollar area. To me that would be the better set up if you are interested in shorting because in that case you still might be able to take advantage of the long as well.

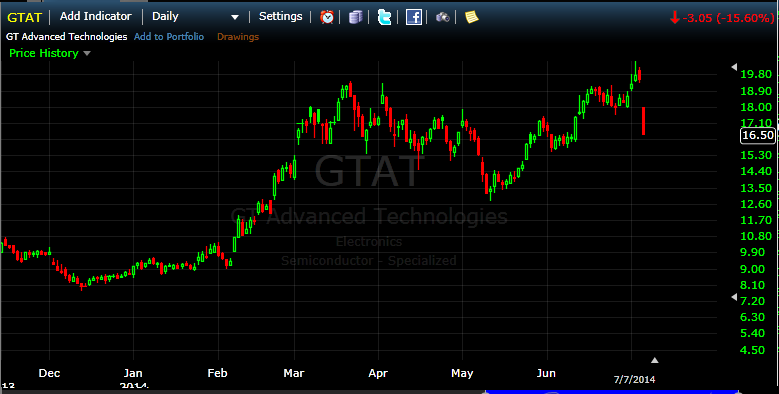

GTAT

This poor thing got hammered Monday. A lot of times when the stocks get crushed they follow through with more selling the next day. There’s two ways to play this depending on how the stock moves early and it would be reverse to what we trade with parabolic’s. For example if there is a big flush and heavy selling in the morning I would look to take advantage of the scalp long as a bounce play. If the first move in the morning is a parabolic or solid upswing I would be more interested in shorting into that early strength as long-term bag holders will be more inclined to sell as soon as they see green

You might enjoy these other posts

5 Things You Must Do To Be Successful

How To Successfully Buy A Terrible Stock

5 Of The Wealthiest Trades In The World

When you know more you do more.

Here is what we got for you:

[column size=”col-6″] [service_type_2 title=”Live On Screen Day Trading” link=”http://thelincolnlist.com/subscribe-2/” icon=”icon-thumbs-up”]

We teach and you learn in real time. TheLincolnList uses a live screen share format for trade alerts and education. Learn live and thrive with our experienced and profitable team. Click here for a free test drive.

[/service_type_2] [/column]

[column size=”col-6″ last_column=”true”] [service_type_2 title=”Live Swing Trades” link=”http://thelincolnlist.com/lincoln-million/” icon=”icon-thumbs-up”]With the same format and attention to detail as our live day trade room we offer Lincoln Million swing trade.If your game is investing for big gains Lincoln Million is your solution Click here for a free test drive.[/service_type_2][/column]

* TheLincolnList.com website is for educational use only. Any opinions, news, research, analysis, prices, tweets, posts or other information contained on this website or any hosted public/social outlet is provided as general market commentary, and does not constitute as investment advice or a solicitation to buy or sell any security of any type. TheLincolnList.com does not take into account your personal circumstances so please do not trade or invest based solely on this information. By viewing any material or using the information within this site you agree that this is general education material and you will not hold any person or entity responsible for loss or damages resulting from the content or general information provided by TheLincolnList.com

Trading stocks has large potential rewards but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest or trade the financial markets. Don’t trade with money you can’t afford to lose. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website. The past performance of any trading system or methodology is not necessarily indicative of future results. For the avoidance of any doubt, TheLincolnList.com does not hold itself as a Trading Adviser (CFP or CFA). Given this representation, all infor