See every trade made live on screen with our desktop sharing trade room. Learn to trade like a pro . Click here for details on how to get started for free.

In the the 1950’s the median home price in the US was $8,500 and the average per person income annually was $3,50o .In 2014 the median home price in the US was 188,000 while the average per person annual income was 27.000. This means in 1950 the average home price was just 2 times the annual wages of a 1950’s worker, while in 2014 the average home price is now 7 times more expensive than an individuals average income. If we take in to consideration that in today’s age its common that most households have multiple incomes and we count the median household income ( adding the entire household earnings Ex Husband and Wife etc) The average home price is still 4 times more expensive than the average wages when we add these incomes. Lets not forget that in 1950’s society it was common that only the men worked while the women stayed at home. So in this case one individuals income in the 1950’s went further in the Real Estate market than two individuals incomes today and these are post real estate bubble numbers.

The income discrepancy between 1950 and 2014 is not just isolated to Real Estate. In 1950 a gallon of gas was 18 cents while the minimum hourly wage was 1.00 per hour . This means the average 1950’s worker spent 20% of their hourly wage on a gallon of gas. In 2014 the minimum wage in the US is $10.10 and a gallon of gas is at a nationwide average of 3.50. A gallon of gas in 2014 now costs 35% of a 2014 workers average hourly wage.

The same could be said for vehicles. In 1950 the average cost of new car was $1,510 , roughly 45% of the average workers annual salary. In 2014 the average cost of a new car is 32,000 Based on the above 2014 average wages of 27,000 annually this makes a new vehicle today 105% more expensive than the average workers annual income.

These numbers are staggering. If we just add the cost of a home and a vehicle in the 1950’s a minimum wage worker would have to work for only 2 years to earn as much as they paid for their home and car, whereas today a minimum wage worker would have to work 9 1/2 years to earn as much as their car and home!

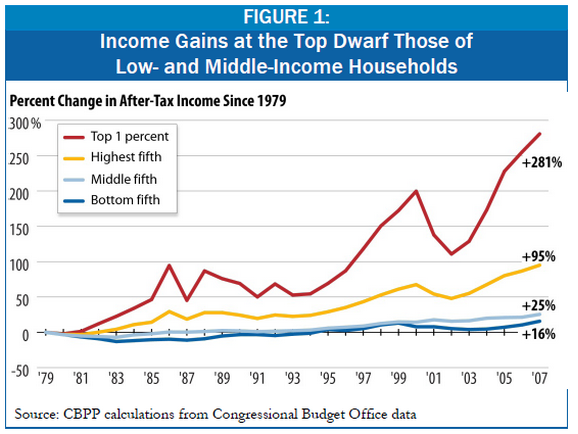

Even though in term of dollars people “earn more” today but the value of that dollar goes far less. At one time you could make the case that a millionaire was rich but in today’s age you could definitely ague that a millionaire is not rich at all. To show you how sickening this really is if you had 100,000 IN 1950 IT WOULD BE THE EQUIVALENCY OF A MILLION TODAY. Middle class in American has all been whipped out but its not all bad for everybody. Since 1950 the upper 1% of the rich have only became richer. The income inequality gap between the middle class and the upper 1 % has increased by over +280%. That sucks if you are not in the upper 1% doesn’t it. Below is a chart showing the rise in income inequality

To read more about adjusted inflation and the differences in calculating percentages click here

As I write this the stock market is at all time highs. Unemployment numbers have decreased quarter after quarter and every day it seems like a new teenage kid is becoming a multi millionaire from creating an app. You would think the world has never been better but the truth is the majority of people on this earth are living below the minimum wage level of 1950 and more an more middle class individuals are sliding in to poverty. In the last 65 years, with all of our technology and advancements employee wages have constantly fallen behind the pace of inflation and the income gap between the rich and the middle class has grown exponentially and we are not even talking about how much debt people are in today as opposed to 1950. You could argue that our quality of living is better than it was in 1950.We do have better Heath care, longer life expectations and more living amenities but from a financial view point, more of our society is living in poverty than at any time in history and most people earn less today than they did in 1950!

My reason for this article is make a point and that point is you can no longer get rich working for someone else. The American dream is just that now – a dream. In today’s society if you want to be of the haves you have to go out a crate your own way otherwise you will be a have not. One of the things that keeps people from creating their own business is that they are afraid to fail however, if you work for someone else you probably are failing anyway. Why waste 10 to 15 years of your life just “getting by” when you can create something of your own that means something. Even if you fail at first its still better because you have gained a real world education and you will be a better person for it .We know now from research of the rich that, by rough estimates, 90 out of 100 men and women reaching this income level are self-made with little to no inheritance. Almost all own or started their own business or work as an executive for a large business.

If you desire is the live the life of freedom and wealth you have no choice but to create your own way. It may suck at first but if you stick with it you just might surprise yourself. My advice – Go For It!

You might enjoy these other posts

Is Emotional Capital The Worst Capital?

How Fast Can You Turn Your Trading Around

5 Huge Losers That Became Successful

What I Learned From Grenadeing My Account

5 Things You Must Do To Be Successful

5 Of The Wealthiest Trades In The World

* TheLincolnList.com website is for educational use only. Any opinions, news, research, analysis, prices, tweets, posts or other information contained on this website or any hosted public/social outlet is provided as general market commentary, and does not constitute as investment advice or a solicitation to buy or sell any security of any type. TheLincolnList.com does not take into account your personal circumstances so please do not trade or invest based solely on this information. By viewing any material or using the information within this site you agree that this is general education material and you will not hold any person or entity responsible for loss or damages resulting from the content or general information provided by TheLincolnList.com

Trading stocks has large potential rewards but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest or trade the financial markets. Don’t trade with money you can’t afford to lose. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website. The past performance of any trading system or methodology is not necessarily indicative of future results. For the avoidance of any doubt, TheLincolnList.com does not hold itself as a Trading Adviser (CFP or CFA).Given this representation, all information and material provided by TheLincolnList is for educational purposes only and should not be considered specific investment advice.