See every trade made live on screen with our desktop sharing trade room. Learn to trade like a pro . Click here for details on how to get started for free.

We’ve been getting several emails regarding which stock screeners we use in the trade room to help us locate which stocks to trade. One large benefit of being a LincolnList member is we provide custom proprietary scanners to all of our members at no additional charge. The custom screens allows our members to trade the same momentum trading strategies in which the room is built around . For example, one of our go to set-ups is the parabolic short with a high RSI. To find these set-ups, we’ve set-up a specific high RSI scanner that searches for stocks with our specified characteristics all throughout the day. It is hard to describe through words, but if you’re in our room, you will see stocks with an 85+ RSI pop in and out of the screen. As these stocks pop up on the screen, you could do a quick analysis to see if they meet your criteria to trade (price,volume, range, etc.)

But what if you’re not a member of our trade room. Maybe you’re just starting out and can’t afford a custom screener. Below is a simple and free momentum stock screener that you can use to day trade or swing trade.

Free Momentum Stock Screener

To understand how to use this stock screener, you must understand how we trade at the Lincoln List. If you need help, don’t hesitate to get in touch with us (support@thelincolnlist.com). Remember, stock scanning is only one component of being a successful stock trader. The free screener exapmle we will be using is ran through the ThinkorSwim platform but can be implemented through most retail brokers like Etrade, Ib Scottrade, Yahoo Finance, Finviz or any other website or platform that has a high of day list or percentage gainers%.

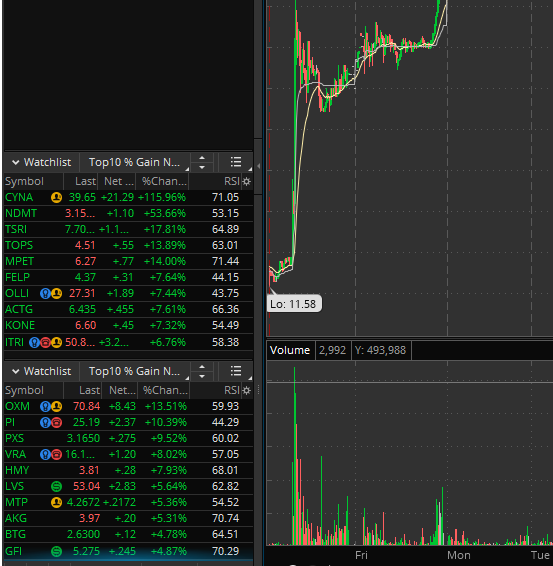

What this screener does is help you build a watchlist of momentum stocks, which is the core of what we trade. We need stocks that are moving or have range. These stocks are moving for some reason. We don’t care why they move but we often find the stocks move because of earnings winners, pumps, hit pieces, a PR, etc.. How you trade momentum stocks is totally up to you but finding stocks moving on high volume allows you to capture true alpha and that is where you want to be. We teach our members to go long and short and focus on one or two set ups they are comfortable with. So as you add stocks to your watchlist, you look for set ups such as the high RSI set up we mentioned above.

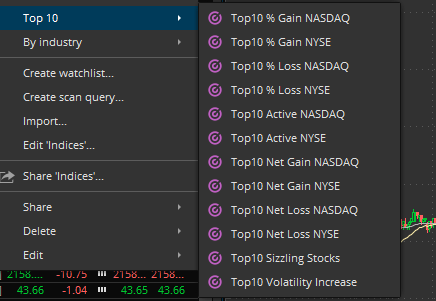

Here is how the screener looks. Simply open a widget on your sidebar (under watchlist) and add Top 10 % Gainers for NASDAQ and NYSE. If you’re working full time or swing trading, you can do this at the end of the day. Set aside 30 minutes and do a quick scan and look for 2 things a) why is the stock up and b) volume. Do this everyday and you will quickly see how you can build a nice list of momentum stocks.

Doug

Here Are Other Recent Articles And Lessons About Setting Stock Scans.

How To Set Up Hot Scans For Interactive Brokers

Review And Set Up Of The Trade Ideas Standard Scanning Software

Review And Of The Trade Ideas Artificial Intelligence “Holly”