“Does Anyone Have any Extra Tickets?”

This weeks post comes to you from LincolnList member -Wall Street Nole

One of my many ventures growing up included the buying and selling of football tickets. Some people called me a scalper or a hustler, but I preferred the name “ticket broker.” It had a good ring to it and sounded professional with my customers.

It was a unique business that most college football fans had trouble grasping. The reality is, the homeless-looking guys that hold up signs saying “I need tickets,” are really not going to the game. By purchasing tickets through different channels including bulk buys and private sales, brokers act as the middle man. Brokers sell tickets to fans coming to the game that have not already purchased tickets from the ticket office. By being a smooth talker and using sales tactics, I became a master at buying tickets on the low from “Aunt Martha”, and turning right around and selling them ten minutes later, at a profit, to “Joe Schmo”, who didn’t really care how much they cost.

Game days were the best and can be compared to trading in the pits. The competition was fierce! The objective was to find the best deals from fans who would sell their tickets at a discount and find buyers who would pay the highest premium. It didn’t take long to notice the general trend that occurred. The overall market value of tickets decreased as kickoff drew closer. This made perfect sense! As more people came to the stadium Supply quickly outnumbered demand, therefore causing ticket prices to drop.

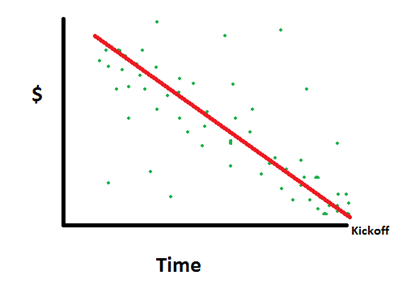

Here is an illustration to show the relationship between the cost of a ticket and the time until kickoff:

At this point, you might be asking yourself, “What in the world does this have to do with trading?” Take notice of the scatter-plot above. Some data points fall well below or above the general downward trend. With so many transactions and participants, this is bound to happen. Sound familiar?

Oftentimes, when we have a high probability trade set-up, we can easily get shaken out of positions. Despite our profit targets, we tend to exit trades early in fear of losing out, taking only a fraction of the original planed profit. Just as there are reasons why someone would pay double the market value close to kickoff for a ticket (drunk, rich, or just dumb), there are just as many reasons why the price action of a stock could deviate before reaching a target. With so many market participants and investment objectives, a trade will rarely happen exactly as planned. Have a set exit strategy if you feel positive your target will not be met. More importantly, give every possible opportunity for the stock to take its course, weeding out the outlying price dips and pops. You might lose out on some small gains from time to time. However, in the long run letting profits run will be worth it to you and your trading account.