See every trade made live on screen with our desktop sharing trade room. Learn to trade like a pro . Click here for details on how to get started for free.

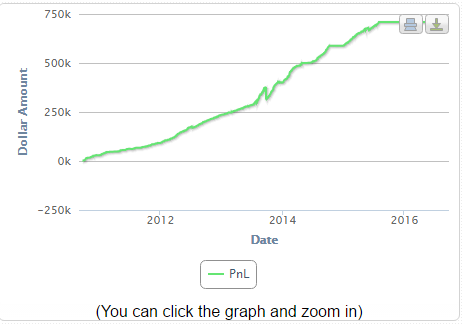

Individuals are amazed when they see a profit and loss chart like the one above. For reasons we don’t want to discuss, we stopped verifying our trades on Profit.ly but each and one of those trades are verified.

Internet bubbles, real estate/ financial crashes, and the recent oil crash, we’ve traded it all. We will also successfully trade any upcoming crisis that the market throws at us. So how exactly do we do it? Simple, we trade strategies that work in any market.

The funny thing is, people think we use a complicated process to achieve these results. We do use advanced scanning software throughout the day and several indicators on our charts, but those are simple add-ons we use to help our members understand pivots, inflection points, and important areas of support an resistance. We would be perfectly fine without any technical indicators on our charts. Personally, I like to joke with our members that each year that I have been taking technical indicators off my charts to clean them up. So what day trading strategies do we employ to obtain a 75+% win rate and steady profits? We only use 4.

If we could sum up our strategies or trading framework, they would fall under:

- Breakout

- Breakdown

- Overbought

- Oversold

Obviously, we can’t go into the set-ups that we use to consistently profit off these strategies but each day there are plenty opportunities in the market that allows us to make small profits that add up and helps us grow our accounts. Most of these could be found in the first hour Let us quickly go over these.

Multi Time Frame Trading Strategy

- Breakouts (long)

- Breakdown (shorts)

This is actually one of our favorite strategies that we don’t trade as much as we should. It is a simple strategy that any trader with any level of experience can implement immediately. We highly recommend these strategies to new traders because each trade is based off a multi time frame analysis and can be made with a set risk-reward. The interesting thing about these types of trades is they have a high win %. Personally, I think I have around a 70% with these , and my risk to reward is something like 2.5 to 1. You will be amazed how many times I was looking to get a quick .50 cents, only to see the stock deliver me a quick $1-$2/share. Why are these types of trade so successful? Because you are breaking important support and resistance levels on multiple chart time frames ( Ex 5 min, 30 min 60 min, daily). You are not buying some random dip or shorting a random pop, these are key price levels that large institutions are watching and trading and price levels that have established themselves over time. To do this type of trading, it is key you have multiple time frames on your charts with key levels being drawn. For example, as you can see on my Think or Swim Chart, that I have the 5 minute chart on one side and the Daily stock chart on the right side. This way, I’m able to get an intra day or short term price picture (I get faked out too many times with the 1 minute chart) and the daily chart, which gives me a view of longer term price levels.

Overbought /Oversold Trading

So if a multi time frame trading strategy works so well, why not stick with it? Because we found something else that works just as well, if not better. In the past couple of years, we have turned our attention to buying and shorting the extremes. In our case, we use the RSI as an overbought and oversold indicator. But you can use any oscillator you are comfortable with. Do we recommend these trade set ups to new members? Of course, but there are a couple of rules you need to follow. We ave found that trading this set-up helps members build their accounts faster and at the same time being able to manage risk. You have to be super disciplined and emotionless though as its impossible to pick the exact top of a run up or the exact bottom of a sell of. Knowing that its important to start with smaller position sizes to give yourself more “wiggle room” in the trade.If you can learn to be patient with these and develop the skill the trades are rock stars and will build your account exponentially.

So why does trading the extremes work (overbought/oversold)? For one, you are taking advantage of amateur traders who are generally more emotional. Finally, it is no secret that stocks tend to overshoot to the downside and to the upside. You are essentially taking advantage of the madness of crowds.

Watch Some Of These Video Lessons.

How My Ego Cost Me The Best Trade Of My Life

What Kind Of Trading Set Up Do You Need?

Where To Find Free Market Scanners

How Long Does It Take To Be A Successful Trader?

How Much Money Do You Need To Start Trading

Is Trading For A Living Possible ?

5 Of The Wealthiest Trades In The World

* TheLincolnList.com website is for educational use only. Any opinions, news, research, analysis, prices, tweets, posts or other information contained on this website or any hosted public/social outlet is provided as general market commentary, and does not constitute as investment advice or a solicitation to buy or sell any security of any type. TheLincolnList.com does not take into account your personal circumstances so please do not trade or invest based solely on this information. By viewing any material or using the information within this site you agree that this is general education material and you will not hold any person or entity responsible for loss or damages resulting from the content or general information provided by TheLincolnList.com

Trading stocks has large potential rewards but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest or trade the financial markets. Don’t trade with money you can’t afford to lose. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website. The past performance of any trading system or methodology is not necessarily indicative of future results. For the avoidance of any doubt, TheLincolnList.com does not hold itself as a Trading Adviser (CFP or CFA).Given this representation, all information and material provided by TheLincolnList is for educational purposes only and should not be considered specific investment advice.